CyberShield features for the security of your finances

- transaction monitoring notifications free of charge: you will receive immediate notifications of any transactions executed

- you can adjust your daily electronic payment limits to your needs

- you can disable the option of electronically activating your new channels

CyberShield for safe banking

With CyberShield, we provide security services with our banking products in an effort to further improve the security of your day-to-day banking.

retail e-banking and mobile banking services

- on 19 February 2025 we introduced an automatic daily limit of HUF 1 million on electronic payments, applicable to all payments sent from your K&H mobile bank or e-bank, thus further improving the security of your finances.

If you believe that your banking needs warrant a higher or lower daily limit than HUF 1 million, you can modify your daily payment limit easily and free of charge. Kate can also help you do this in both e-bank or the mobile bank. - as a retail client, you can instruct us to disable the electronic activation of your new channels. If you do so, you will need to request help from our advisors at customer points or by video call if you wish to activate a new channel (e.g. K&H mobile bank/e-bank) subsequently, but this will give you greater certainty that only you can activate your new channels.

business e-banking and mobile banking services

- on 19 February 2025 we introduced an automatic daily limit of HUF 1 million on electronic payments, applicable to all payments sent from your K&H mobile bank or e-bank, thus further improving the security of your finances.

If you believe that your banking needs warrant a higher or lower daily limit than HUF 1 million, you can modify your daily payment limit easily and free of charge. Kate can also help you do this in both e-bank or the mobile bank.

Electra users

A limit management option has been available in the K&H Electra channel since September 2024.

- for each account, the signature scores a user needs for authorising orders can be set up for specific amount ranges (to-from)

- user signature scores can be set up differently for each account

Take advantage of the security provided by setting up limits! We recommend you set limits for your accounts both reflecting your payment needs and preventing the execution of unusual payment transactions.

This feature is available from the client self-administration platform (in the settings/authorisation management/signature limits menu).

CyberShield messages on lifecycle changes of cashless payment instruments

bank cards

- card activation

‘We have activated your card ending in 1122 and it is now ready for transactions. If this was not initiated by you, please call the K&H TeleCenter immediately at +36 1/20/30/70 335 3355.’

Once you have activated it, you can use your bank card up to the limits you have set up. If you did not request activation, your card may have fallen into the hands of unauthorised persons, who may make payments without your approval. If this is the case, please call the K&H TeleCenter immediately.

- requesting a new card

‘We have issued a new bank card for you as requested. Once the card has been manufactured, we will post it to the postal address provided by you. If you did not request a replacement, please call the K&H TeleCenter immediately at +36 1/20/30/70 335 3355.’

If you receive this message, it means that we have issued a new card for an account you have. If you did not request this, the persons who did so may carry out transactions without your approval. If the card was not requested by you, please call the K&H TeleCenter.

- bank card digitalisation

‘We have digitalised your card ending in 1122. If you did not request this, please call the K&H TeleCenter immediately at +36 1/20/30/70 335 3355.’

This is the message you will receive after your card is digitalised. If you did not request your card to be digitalised, unauthorised persons may have accessed your mobile banking or bank card details. If this is the case, please call the K&H TeleCenter.

- SZÉP Card digitalisation

‘We have digitalised your SZÉP Card ending in 1122. If you did not request this, please call the K&H TeleCenter immediately at +36 1/20/30/70 335 3355.’

This is the message you will receive after your SZÉP Card is digitalised. If you did not request your SZÉP Card to be digitalised, unauthorised persons may have accessed your mobile banking or your SZÉP Card details. If this is the case, please call the K&H TeleCenter.

electronic channel

- notification of successful activation of K&H mobile bank

‘You have activated a new K&H mobile bank application on your iOS 18.3.2 device. If you did not request this, please immediately delete the mobile token in your e-bank in the e-bank settings/login options/identification devices menu and call the K&H TeleCenter at +36 (1/20/30/70) 335 3355! K&H Bank.’

This is the message you will receive after mobile bank activation. If you did not request mobile bank to be activated, unauthorised persons will have carried out the activation in your name and gained full access to your accounts, cards and other banking products. If the request did not come from you, please call the K&H TeleCenter immediately!

- successful initial login to K&H mobile bank

‘Please note that we have detected a successful initial login to the K&H mobile banking app. If you did not request this, please call the K&H TeleCenter! K&H Bank’

You will receive this message after you log in to the mobile bank for the first time. If you did not log in, unauthorised persons will have done so and gained full access to your accounts, cards and other banking products. If the request did not come from you, please call the K&H TeleCenter immediately!

CyberShield transaction monitoring notifications

- transaction monitoring notifications with a broader scope: in addition to the debit card transactions of our cardholders, our account holder clients will now be notified of any HUF and FX transactions initiated on their accounts electronically.

In these CyberShield transaction monitoring notifications, cardholders will be informed of any debit transactions for amounts of over HUF 15,000 made with their debit cards, while account holders will be notified of any electronic payments initiated on their accounts. This means that you can now take immediate action when you are notified of any card or electronic payment transaction not initiated by you.

what is a CyberShield transaction monitoring notification?

In line with recommendation 5/2023. (VI.23.) of the National Bank of Hungary, we send free of charge notifications of debit card transactions and electronic payments of over HUF 15,000. These notifications are intended to inform our cardholder and account holder clients immediately of any transactions executed with their debit cards or electronically on their accounts that reduce their balances significantly. If they deem a transaction suspicious or know that it was not executed by them, they can act immediately to safeguard their account/card – for instance by blocking their card in K&H mobile bank or by calling the K&H TeleCenter. Thus we have further improved the security of your finances.

who will receive these notifications?

debit card payments

- all private individuals who hold a K&H debit card; and

- persons nominated as cardholders on the debit cards of businesses with a headcount below 10 and an annual sales revenue of less than EUR 2 million

electronic payments

- Any private individual with an account or any account holder business with a headcount below 10 and an annual sales revenue of less than EUR 2 million that initiates electronic payments

transactions about which you will receive CyberShield transaction monitoring notifications

You will receive notifications about every debit card payment of over HUF 15,000 and every electronic payment.

what form will CyberShield transaction monitoring notifications take?

If you are registered for K&H mobile bank and have enabled notifications from the app in your phone settings, you will receive our messages as push notifications.

If you are not a K&H mobile bank user, you will receive these notifications as SMS text messages.

what does a CyberShield transaction monitoring notification contain?

CyberShield transaction monitoring notifications have the following standard wording: ‘Please note that we have detected a transaction made with your bank card. If you did not initiate it, please call the K&H TeleCenter at +36 1/20/30/70 335 3355!’ or ‘Please note that a payment has been made from your account. If you did not initiate this transaction, please call the K&H TeleCenter at +36 1/20/30/70 335 3355!’ Please note: CyberShield transaction monitoring notifications do not contain transaction details or personal data, and K&H Bank will never ask you for your personal data and/or banking identifiers in these messages!

do I need to pay for these messages or the CyberShield transaction monitoring notification service?

No, the CyberShield transaction monitoring notification service and all the messages will be free of charge.

I already use the Mobilinfo SMS service, do I need to do anything about that?

Your Mobilinfo service will remain active and subject to your existing settings and our contract terms and conditions. If we detect a card transaction of over HUF 15,000 on your card, you will receive both a Mobilinfo and a CyberShield transaction monitoring notification if your Mobilinfo notification limit is also set to HUF 15,000 or lower. You will continue to receive Mobilinfo messages about electronic payments subject to your limit settings, but you will now also receive the CyberShield transaction monitoring notifications of all such debit transactions (regardless of amount).

We recommend you keep your Mobilinfo service if you find its messages useful as they contain information not included in the free CyberShield transaction monitoring notifications, such as transaction amount, merchant, transaction location and your new account balance after the transaction.

Debit card holders can unsubscribe from the CyberShield transaction monitoring notification service. Please be aware that if you unsubscribe, this will apply to all your cards (retail as well as business); the setting will not be limited to a specific card. If you unsubscribe from debit card transaction notifications, we will also stop sending you notifications of electronic payment transactions. If you unsubscribe from either of these two notification types, we will stop sending you CyberShield transaction monitoring notifications altogether. You can unsubscribe:

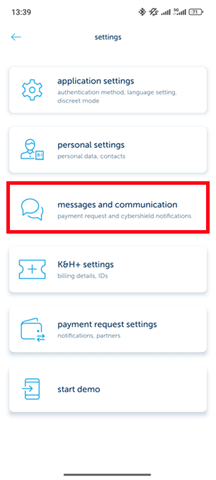

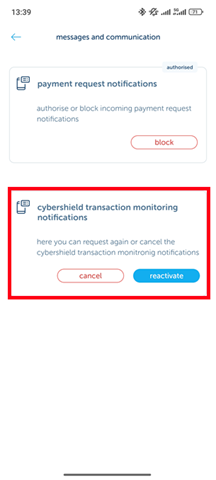

as a private individual

- in K&H mobile bank by clicking Block in the CyberShield transaction monitoring notifications section of the Settings/Messages and communication menu. This feature will be included in the new version of K&H mobile bank, which is gradually being rolled out for download.

- calling +36 1/20/30/70 335 3355, selecting menu 2 (‘bank account, bank card, e-bank and mobile bank services’) and then submenu 3, and going through eID/ePIN identification

- in person at customer points: just tell an advisor at any of our customer points that you wish to unsubscribe from CyberShield transaction monitoring notifications

as a sole trader or business

- with the exception of the K&H mobile bank process, business debit card holders can follow the same unsubscribe procedures as private individuals, and they can also instruct us on messaging at our customer points: they can just tell an advisor that they wish to unsubscribe from CyberShield transaction monitoring notifications concerning their business debit cards

as a company

- with the exception of the K&H mobile bank process, business debit card holders can follow the same unsubscribe procedures as private individuals or declare their wish to unsubscribe by calling the K&H Corporate Customer Service at +36 1 468 7777 or +36 1 468 7755

- the bank processes requests to unsubscribe in maximum 2 working days, after which all Cyberinfo messages will be stopped