K&H regular investments on your mobile

invest your money using K&H mobilbank!

- it’s convenient – it only takes a few minutes to set up, wherever you are

- you only need to set it up once; you have nothing more to do, unless you want to make changes

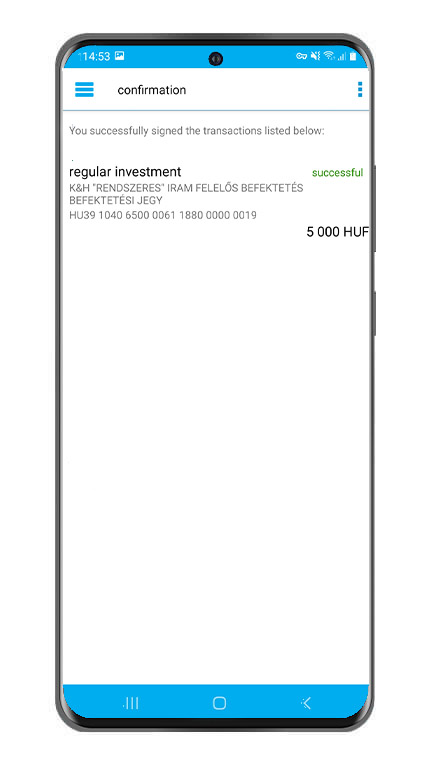

- you can also invest small amounts, from just 5 000 HUF per month

what is regular investment?

key steps

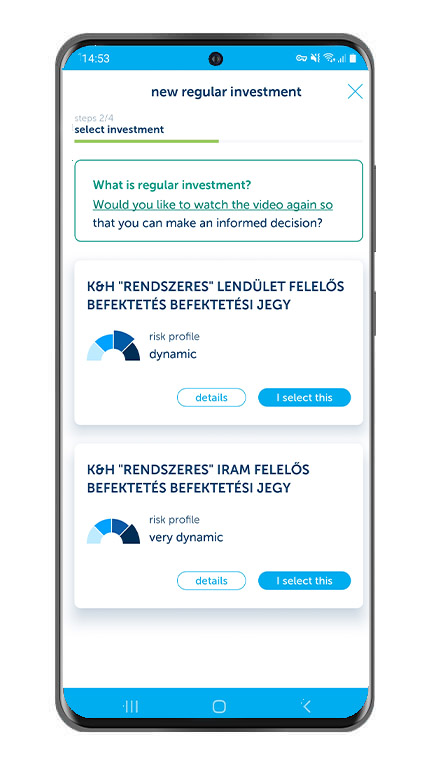

choose from four investment units

open a securities account if you do not have one

finally, sign the transaction

details

- choose from the following four products:

|

|

K&H rendszeres kényelem felelős befektetés investment unit |

K&H rendszeres lendület felelős befektetés investment unit |

K&H rendszeres iram felelős befektetés investment unit |

K&H rendszeres állampapír felelős befektetés investment unit |

|

portfolio composition |

full portfolio comprising a mix of equities and bonds, with prevalence of bonds |

full portfolio comprising a mix of equities and bonds, with prevalence of equities |

full portfolio comprising a mix of equities and bonds, with prevalence of equities |

a portfolio of short-term hungarian government bonds |

|

type |

open-end, no fixed maturity |

open-end, no fixed maturity |

open-end, no fixed maturity |

open-end, no fixed maturity |

|

sustainability (underlying assets) |

the fund invests into the assets of responsibly operating market players |

the fund invests into the assets of responsibly operating market players |

the fund invests into the assets of responsibly operating market players |

the fund invests into the assets of responsibly operating market players |

|

risk profile |

defensive |

dynamic |

very dynamic |

defensive |

|

FX exposure |

yes |

yes |

yes |

no |

what are the benefits of regular investment?

They say, ‘a penny saved is a penny earned’. However, today’s consumer culture hardly encourages us to take heed of this ancient wisdom; instead, we wonder how our parents and grandparents were able to save any money, given their modest earnings. But we can follow their example – here is how.

key attributes of regular investment

- When it comes to investments, timing is always crucially important. However, experts often stress that it is virtually impossible to pinpoint the moment when the market will hit rock bottom, i.e. the right moment to invest. Investing regularly also helps with this as each purchase will be made automatically the same time every month but the market will be at a different point every time. This spreads your entry risk and makes your investment much safer.

- Return on investment can also earn return; this is called “compound interest effect”, which enables you to earn additional money in the long term without having to lift a finger.

- You can and should make regular savings for both short- and long-term goals. For example, you can save regularly for a year for a family trip or for your pension.

- You can have any number of regular investment orders simultaneously, but you may want to adjust the number of your orders according to your savings goals and invest in different funds, depending on what you are saving for.

- You can also invest small amounts per month; investment units are available in K&H mobilbank from just 5 000 HUF.

to set up a regular investment on your mobile:

- select one of the four investment units

- select the account in which you wish to set up your regular investment

- enter the amount you would like to invest each month (between 5 000 HUF and 20 000 000 HUF)

- specify the start date of your regular investment - it can be the next working day at the earliest and in 45 days at the latest

- if you do not have a securities account with us, then open one; to do this, please enter your tax ID

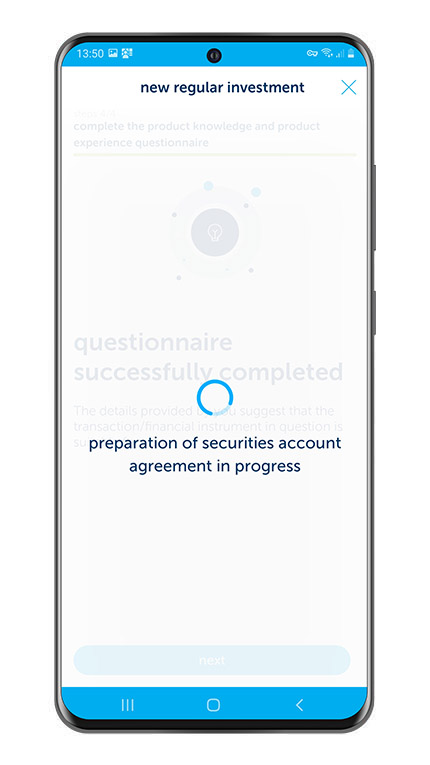

- please complete our product knowledge and product experience questionnaire by answering six questions; this is necessary so that we can establish whether the product of your choice is suitable for you. If you have already completed such a questionnaire, you may use it here

- if you are opening a securities account, sign the account agreement, then simply sign the transaction itself and you are done

- if you need technical help or an error occurs in your application, please contact us using the K&H quick call function

- please note that only standing orders may be cancelled in K&H mobilbank; to cancel a regular investment order, please use K&H e-bank or visit a branch

- if you decide that you would like to invest more on a monthly basis, then you can give another regular investment order

- only your order can be executed in K&H mobilbank; if you need investment advice, please come and consult one of our experts at a K&H customer point

We draw your attention to the consumer protection website of Financial Navigator Advisory of the National Bank of Hungary where you can find useful product descriptions and various applications for comparison (loan calculator, budget calculator for households).

This notice is considered marketing communication, and it does not constitute an offer; its sole purpose is to draw attention to a product and/or service whose detailed description and terms and conditions are set out in the Agreement in question; the General Contracting Terms and Conditions for Bank Account, Deposit Account and Term Deposit Products; the General Contracting Terms and Conditions for Bankcard and Credit Card Services; the General Contractual Terms and Conditions of Retail Loans; the General Contracting Terms and Conditions for Banking Services Requiring Electronic Identification; the General Terms and Conditions of K&H Bank; the Announcement on the Bank Accounts, Deposit Accounts, Term Deposits and Cash Transactions of Private Individual Customers; the K&H Debit Bankcard Announcement of Private Individual Customers; the K&H Credit Card Announcement for Private Individual Customers; the Announcement on K&H Forint Overdraft; the General Terms and Conditions for Investment and Complementary Investment Services Provided by K&H Bank; and the Announcement on the Fees and Charges on Investment Services and Securities Transactions. The criteria for participating in the Promotion are set out in the Terms and Conditions of Participation. The investment funds are managed by the Hungarian Branch Office of KBC Asset Management N.V. Insurance services are provided by K&H Insurance; the details of the relevant product are set out in the applicable insurance terms and conditions. The Bank reserves its right to change the terms and conditions.