K&H Factor

Connection

-

faktor@kh.hu

-

+36 1 328 9946

-

1095 Budapest, Lechner Ödön fasor 9.

introduction

K&H Factor is the wholly-owned subsidiary of K&H Bank Zrt. It is engaged in factoring and the purchase of receivables, serving organizations in the SME and corporate sectors. Its philosophy is to offer solutions tailored to its clients’ requirements and facilitate their growth. K&H Factor was established in 2009, and since then with its steadily increasing turnover it has become a major player in the Hungarian factoring market.

detailed introduction

K&H Factor provides financing services for its clients through the factoring and purchase of short-term trade receivables. It offers sophisticated solutions to its clients’ needs for optimal receivables management by developing its systems continuously, having a team of qualified and experienced professionals and adapting quickly to the market and legal environment.

The buyers of the financed suppliers include hypermarkets, large manufacturing and service companies, state-owned and municipal institutions (hospitals, schools) and foreign companies alike. K&H Factor develops its product range continuously, taking into consideration the demands of the market and the possibilities offered by legislation. As a result of its innovative approach, its service portfolio includes several products that are unique in the Hungarian factoring market.

In addition to classic accounts receivable factoring, it also offers its clients services and solutions that meet the increasingly complex financial requirements.

services:

- accounts receivable factoring

- supplier program

- invoice discounting

individual solutions:

- improving the working capital position according to the client’s requirements

- off-balance sheet financing

- managing the entire receivables portfolio

- receivables insurance

- purchasing receivables without recourse

benefits of factoring:

- quick financing

- favorable collateral structure

- follows the growth of clients flexibly

- transparent receivables management and information

- predictable costs

- improves the payment performance of buyers

services, individual solutions

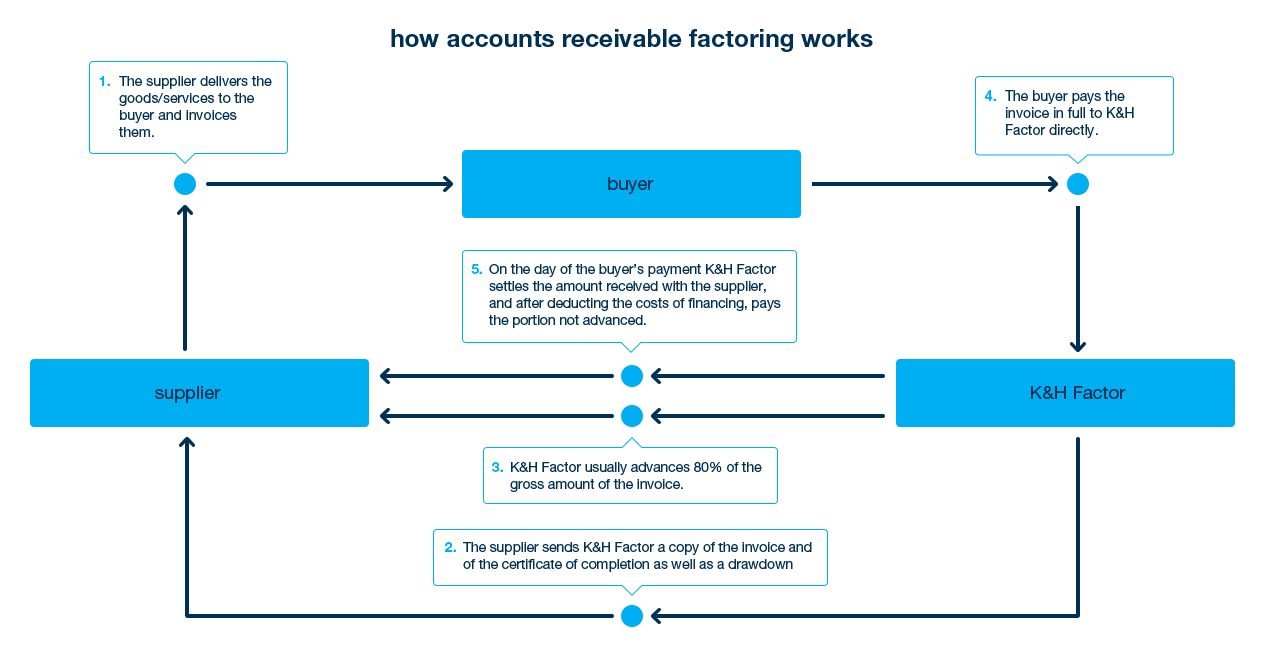

how accounts receivable factoring works

K&H Factor purchases and advances short-term, non-overdue trade receivables that have been acknowledged and confirmed by the buyers of the goods/services, thus helping its clients obtain the funds faster.

As part of its factoring services, K&H Factor keeps records of the amounts due to its clients from their prequalified buyers, advances an average 80% of the invoice amount and disburses the advance to the client’s bank account as early as the day the invoice is submitted. When the invoice amount is received from the buyer, K&H Factor deducts its costs and transfers the remaining amount to its client in full.

In the case of export factoring, K&H Factor factors the amounts due to its clients from their foreign buyers. Following a credit investigation, K&H Factor takes out credit insurance on the foreign buyer, which reduces the supplier’s loss in the event the buyer defaults. In this case the supplier runs a risk of 10%.

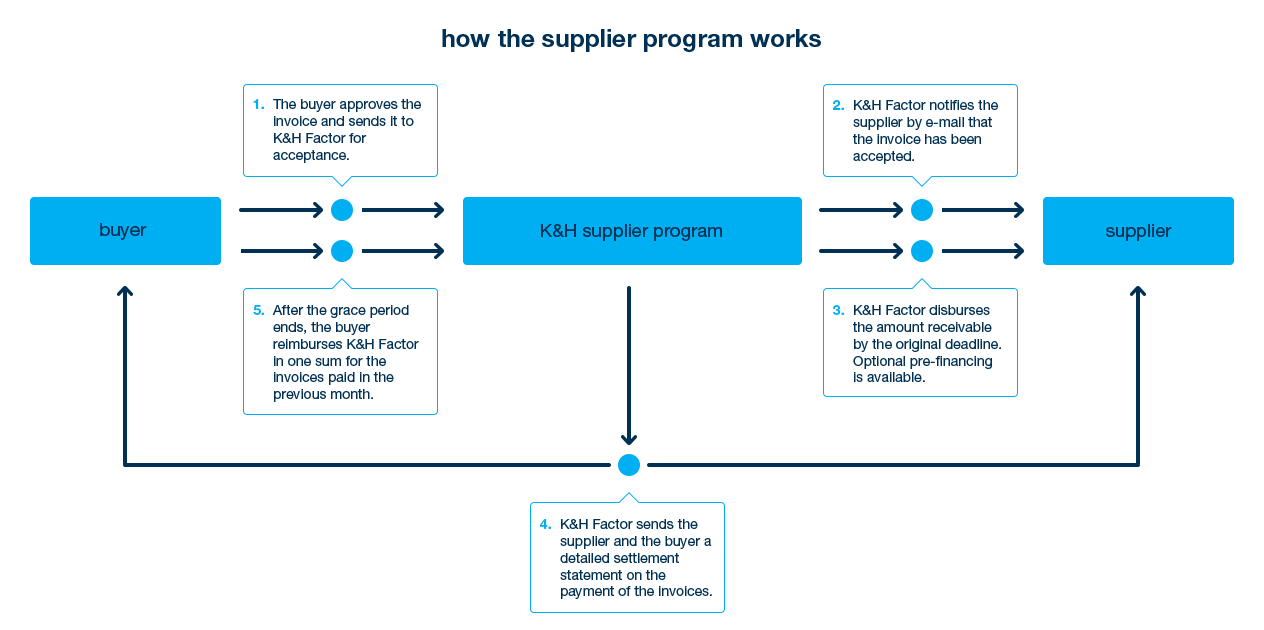

how the supplier program works

K&H Factor has developed its Supplier Program to improve the working capital position of its corporate clients and offer them a solution to their financing needs.

Under the Program the corporate clients of K&H Factor can grant their suppliers longer payment periods, while suppliers can receive payment for their goods/services immediately after delivery. The Program allows clients to schedule and combine their payments to suppliers as necessary.

Benefits of the program:

- A financing option for suppliers under more favorable terms than those available on the market and without additional collateral. The suppliers covered by the Program receive the amount of their invoices issued to, and acknowledged and confirmed by, K&H Factor clients from K&H Factor on the day the invoice is issued or is confirmed by the client. This means that suppliers can obtain funds immediately upon delivery. Supplier financing is based on the clients’ risk, and in return clients can request an early payment discount from their suppliers.

- Payment periods can be extended to 120-150 days – in compliance with applicable law. K&H Factor offers its clients ex-post financing that can be 30-90 days longer than the original payment period. This solution also allows suppliers to receive payment for their goods/services immediately upon delivery based on the client’s confirmation. If they do not need this option but the client wants to take advantage of the longer payment period, factor financing can also start on the due date of the invoice. In this case K&H Factor pays the supplier invoices on their due date instead of the client, and grants the client a grace period of 60-90 days for payment.

- Minimal administration and a high degree of flexibility: the entire financing process is handled electronically; there is no need to send in invoices or delivery notes.

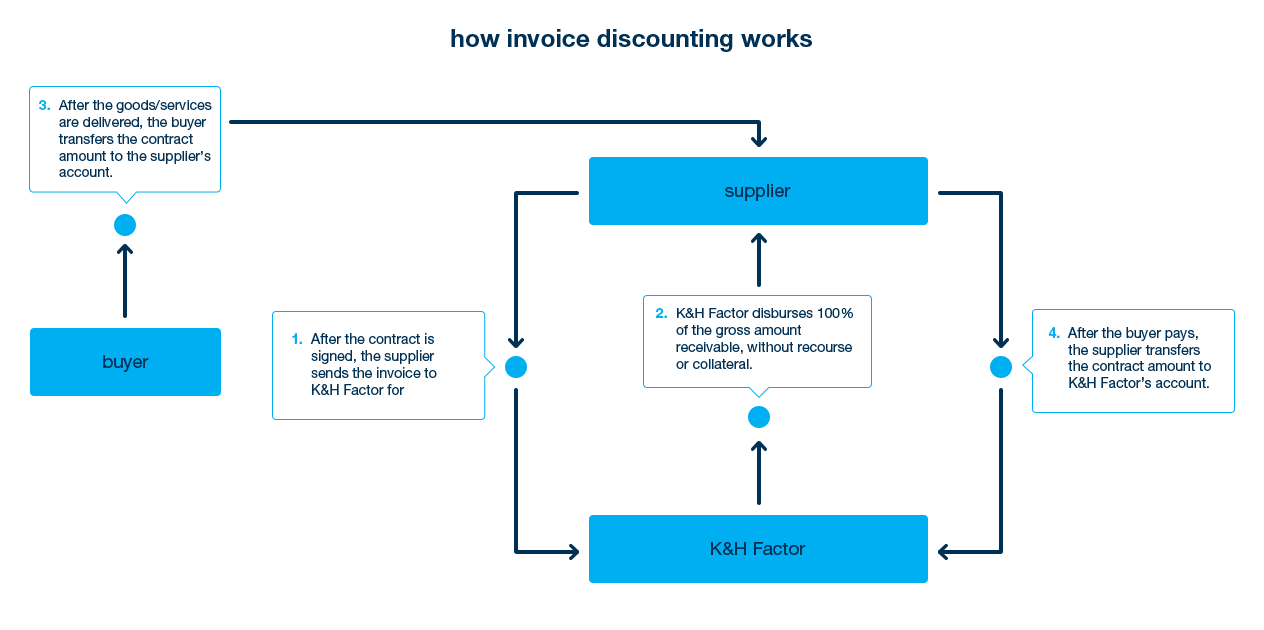

how invoice discounting works

K&H Factor has developed Invoice Discounting, a premium product in the Hungarian market, to reduce its clients’ risks arising from buyer default, optimize their balance sheet structure and offer them a solution to their financing needs.

In Invoice Discounting K&H Factor buys the client’s trade receivables without recourse, paying as much as 100% of the gross amount receivable. K&H Factor can assume as much as 100% of the payment risk of the trade receivables purchased in Invoice Discounting, without notifying the buyers of the purchase of the receivables.

Benefits:

- K&H Factor can assume the risk of buyer non-payment in full

- buyers are not notified (‘silent’ purchase of receivables)

- fast, simple and immediate financing: K&H Factor can disburse as much as 100% of the receivables purchased to the client

- minimal administration and a high degree of flexibility: the entire financing process is handled electronically;

- financing is available almost immediately after the contract is signed, as there is no need to notify the buyers or have them confirm the receivables.